Kód: 24433904

EU Tax Law

Autor Juliane Kokott

The book"Taxes are the lifeblood of government." (U.S. Supreme Court 1935). They are the fundament of statehood, but more and more the subject of European regulation and international concern. This book systematically analyses the ... celý popis

- Jazyk:

Angličtina

Angličtina - Väzba: Pevná

- Počet strán: 809

Nakladateľ: Beck C. H., 2022

- Viac informácií o knihe

Mohlo by sa vám tiež páčiť

-

Eu Tax Law: A Handbook

464.76 € -

EU Immigration and Asylum Law

363.07 € -

EU Law

64.54 € -

The Personal MBA 10th Anniversary Edition

31.50 € -

Behind the Beat

40.20 € -

Income Tax Fundamentals 2023

274.78 € -

Playful Production Process

53.70 € -11 % -

Taxation in European Union

126.95 € -

Taxes For Dummies 2022 Edition

29.04 € -

Value Added Tax

99.33 € -

Treaty on the Functioning of the European Union - A Commentary

382.61 € -

C++ Templates

79.17 € -1 % -

Treaty on European Union (TEU)

319.18 € -

Research Handbook on European Union Taxation Law

304.45 € -10 % -

Computer Engineering

146.08 € -

Crucial Conversations

18.71 € -23 % -

Artists' Master Series: Color and Light

36.31 € -14 % -

![Customs and Excise Tariff [microform] Customs and Excise Tariff [microform]](https://media.libris.to/jacket/37577030t.jpg)

Customs and Excise Tariff [microform]

39.07 € -

Value Added Tax

14.62 € -

Art of Tyler Jacobson

41.22 € -19 % -

![Customs and Excise Tariff [microform] Customs and Excise Tariff [microform]](https://media.libris.to/jacket/37466781t.jpg)

Customs and Excise Tariff [microform]

23.83 € -

Wireless Communications Systems

183.83 € -

Computer Engineering

813 € -

Artists' Master Series: Composition & Narrative

36.31 € -14 % -

Atemi Waza Kodokan Judo - Practical Applications

52.47 € -

My Dress-Up Darling 09

13.60 € -17 % -

SW ART OF STAR WARS JEDI SURVIVOR

42.86 € -16 % -

ART OF MARVELS SPIDERMAN 2 DLX ED

110.27 € -13 % -

Economic and Monetary Union

74.47 € -

Tax Evasion and the Black Economy

58.20 € -4 % -

Textbook on International Law

52.57 € -16 % -

The Illusion of Life : Disney Animation

59.53 € -2 % -

Corporate Income Tax Harmonization in the European Union

70.78 € -

Cash Flow Analysis and Forecasting - The Definitive Guide to Understanding and Using Published Cash Flow Data

105.77 € -

EU Consumer Law

509.67 € -

Effective Modern C++

50.22 € -16 % -

Fundamentals of Laser Dynamics

185.67 € -

European Union Health Law

221.27 € -

Leaders Eat Last

16.05 € -

Allocating Taxing Powers within the European Union

139.43 € -

European Union and Social Security Law

166.23 € -

Exit West

10.53 € -24 % -

HAND-BOOK OF INCOME TAX LAW & PRACTICE:

34.36 € -

Terra/Wattel - European Tax Law

172.99 € -

ISE Principles of Corporate Finance

74.88 € -8 % -

Jurisdiction to Tax Corporate Income Pursuant to the Presumptive Benefit Principle

214.01 € -

Psychológia

5.72 € -20 % -

A Streetcar named Desire

7.05 € -2 % -

Direkt interaktiv 1 (A1) Intensivtrainer

6.84 €

Darčekový poukaz: Radosť zaručená

- Darujte poukaz v ľubovoľnej hodnote, a my sa postaráme o zvyšok.

- Poukaz sa vzťahuje na všetky produkty v našej ponuke.

- Elektronický poukaz si vytlačíte z e-mailu a môžete ho ihneď darovať.

- Platnosť poukazu je 12 mesiacov od dátumu vystavenia.

Viac informácií o knihe EU Tax Law

Nákupom získate 652 bodov

Anotácia knihy

Anotácia knihy

The book"Taxes are the lifeblood of government." (U.S. Supreme Court 1935). They are the fundament of statehood, but more and more the subject of European regulation and international concern. This book systematically analyses the Tax Law of the European Union, which has developed in the space between the national legal orders of the Member States on the one hand and the international regime (particularly the influences of the OECD, including BEPS) on the other. In that framework, the author considers the whole body of the Tax Law of the European Union: the general principles applicable to both direct and to indirect taxation; the principle of equality and its more specific expressions in the basic freedoms and the prohibition of State aid, the principles of neutrality and ability to pay, taxpayers' fundamental rights; the justifications of infringements -- balanced allocation of taxing powers, including the fight against tax avoidance; secondary legislation in the area of direct taxes; and details of the Union's VAT law and excises taxes. The reader will find everything in this book.The advantages at a glance- Comprehensive And Systematic Update Of The Vast Case-law Of The Ecj- Detailed Analysis Of The Various Eu Tax Law Problems, Including Vat- The Broad Context Of Constitutional And International LawThe target groupFor Tax lawyers, both academics and practitioners, active in the areas of direct or indirect taxation. Teachers and practitioners of EU law, students.

Parametre knihy

Parametre knihy

263.63 €

- Celý názov: EU Tax Law

- Autor: Juliane Kokott

- Jazyk:

Angličtina

Angličtina - Väzba: Pevná

- Počet strán: 809

- EAN: 9783406743955

- ISBN: 3406743951

- ID: 24433904

- Nakladateľ: Beck C. H.

- Hmotnosť: 1502 g

- Rozmery: 48 × 172 × 50 mm

- Dátum vydania: 08. July 2022

Obľúbené z iného súdka

-

Haunting Adeline

30.78 € -

Berserk Deluxe Volume 1

48.28 € -5 % -

Berserk Deluxe Volume 3

51.65 € -

Berserk Deluxe Volume 2

52.88 € -

LEGO Star Wars Visual Dictionary Updated Edition

22.80 € -9 % -

Atomic Habits

15.95 € -15 % -

White Nights

3.57 € -24 % -

Powerless

12.37 € -5 % -

Berserk Deluxe Volume 5

50.43 € -1 % -

Hunting Adeline

31.81 € -

Harry Potter and the Prisoner of Azkaban (Minalima Edition)

27.20 € -33 % -

Chainsaw Man, Vol. 15

10.42 € -23 % -

House of Leaves

23.21 € -4 % -

Iron Flame

16.26 € -19 % -

Cry Baby Coloring Book

9.81 € -13 % -

JUJUTSU KAISEN V22

12.47 € -7 % -

Gravity Falls Journal 3

22.09 € -

The Official Stardew Valley Cookbook

28.02 € -4 % -

The 48 Laws of Power

26.08 € -4 % -

Dune Messiah

8.99 € -20 % -

Berserk Deluxe Volume 4

48.18 € -5 % -

Heaven Official's Blessing: Tian Guan Ci Fu (Novel) Vol. 2

18.71 € -12 % -

Dune

10.53 € -14 % -

Twisted Love

12.37 € -5 % -

Surrounded by Idiots

11.75 € -21 % -

Twisted Lies

9.81 € -24 % -

A Little Life

17.48 € -

Berserk Deluxe Volume 6

51.14 € -

Heaven Official's Blessing: Tian Guan Ci Fu (Novel) Vol. 1

18.10 € -14 % -

Twisted Games

9.81 € -24 % -

Bungo Stray Dogs, Vol. 8 (light novel)

16.56 € -

CHAINSAW MAN V14

11.24 € -14 % -

Fourth Wing

11.04 € -15 % -

King of Sloth

10.73 € -17 % -

48 Laws Of Power

22.60 € -5 % -

Court of Thorns and Roses

9.30 € -20 % -

The Husky and His White Cat Shizun: Erha He Ta de Bai Mao Shizun (Novel) Vol. 5

20.14 € -5 % -

Heaven Official's Blessing: Tian Guan Ci Fu Vol. 4

18.71 € -10 % -

Court of Thorns and Roses Paperback Box Set (5 books)

59.53 € -5 % -

Court of Mist and Fury

9.40 € -19 % -

Berserk Deluxe Volume 10

58.81 € -13 % -

Raising Mentally Strong Kids: How to Combine the Power of Neuroscience with Love and Logic to Grow Confident, Kind, Responsible, and Resilient Child

30.37 € -

No Longer Human

16.56 € -

Vagabond (VIZBIG Edition), Vol. 1

24.54 € -14 % -

Twisted Series 4-Book Boxed Set

38.66 € -23 % -

Powerful

11.45 € -13 % -

Dead Poets Society

8.17 € -21 % -

A Court of Silver Flames

10.12 € -22 % -

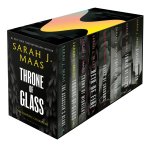

Throne of Glass Box Set (Paperback)

94.93 € -4 %

Collection points Bratislava a 2642 dalších

Copyright ©2008-24 najlacnejsie-knihy.sk All rights reservedPrivacyCookies

15549 collection points

15549 collection points Delivery 2.99 €

Delivery 2.99 € 02/210 210 99 (8-15.30h)

02/210 210 99 (8-15.30h)