Kod: 01199039

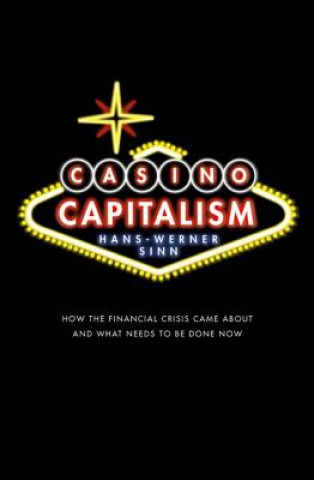

Casino Capitalism

Autor HansWerner Sinn

In Casino Capitalism Hans-Werner Sinn examines the causes of the banking crisis, points out the flaws in the economic rescue packages, and presents a master plan for the reform of financial markets. Sinn argues that the crisis cam ... więcej

- Język:

Angielski

Angielski - Oprawa: Miękka

- Liczba stron: 402

Wydawca: Oxford University Press, 2012

- Więcej informacji o książce

54.68 €

Dostępna u dostawcy w małych ilościach

Wysyłamy za 9 - 12 dni

Potrzebujesz więcej egzemplarzy?Jeżeli jesteś zainteresowany zakupem większej ilości egzemplarzy, skontaktuj się z nami, aby sprawdzić ich dostępność.

Dodaj do schowka

Zobacz książki o podobnej tematyce

-

Energy in Nature and Society

82.52 € -

Harvesting the Biosphere

32.58 € -17 % -

Lupus Encyclopedia

38.63 € -9 % -

Introduction to Sustainable Development

63.76 € -4 % -

Transitions to Sustainable Development

200.57 € -

Practical AVR Microcontrollers

48.72 € -18 % -

Green Paradox

36.72 € -18 % -

No Way Home

18.45 € -18 % -

Graphic Agitation 2

75.66 € -

Auf Dem Vestenstein

53.67 € -

β-lactams

79.70 € -

Future Access Enablers for Ubiquitous and Intelligent Infrastructures

61.44 € -

111 Orte in Tirol, die man gesehen haben muß

16.94 € -9 % -

Persian Historic Urban Landscapes

137.71 € -10 %

Podaruj tę książkę jeszcze dziś

- Zamów książkę i wybierz "Wyślij jako prezent".

- Natychmiast wyślemy Ci bon podarunkowy, który możesz przekazać adresatowi prezentu.

- Książka zostanie wysłana do adresata, a Ty o nic nie musisz się martwić.

Więcej informacji o Casino Capitalism

Za ten zakup dostaniesz 137 punkty

Opis

Opis

In Casino Capitalism Hans-Werner Sinn examines the causes of the banking crisis, points out the flaws in the economic rescue packages, and presents a master plan for the reform of financial markets. Sinn argues that the crisis came about because limited liability induced both Wall Street and Main Street to gamble with real estate properties. He meticulously describes the process of lending to American homeowners and criticizes both the process of securitizing and selling mortgage claims to the world, as well as the poor job rating agencies did in providing transparency. He argues that the American Dream has ended because the world now realizes that this dream was built on loans that are never likely to be repaid. Sinn also asserts that the banking crisis has not yet been resolved, because the necessary write-offs of toxic assets have largely been swept under the carpet. Comparing actual worldwide write-offs with those estimated by the IMF estimates, he concludes that substantial parts, if not most, of the true losses have yet to be revealed and that the banking systems of many countries are on the brink of insolvency. In view of this, he directs sharp criticism at the various economic rescue packages, arguing that the plans assume that banks have a liquidity problem while, in fact, they suffer from a solvency crisis. Sinn points out that the conflict between the goals of rescuing banks in the short term and inducing more prudent behaviour in the long term requires the government to help the banks, but not their shareholders, by becoming a temporary co-owner. In addition, he calls for higher equity requirements, a worldwide return to more cautious accounting methods, a ban on extremely speculative short selling, and strict regulations on conduits, hedge funds and credit default swaps. This authoritative account provides an invaluable overview for academics, students, policymakers, politicians, and all those with an interest in the unprecedented 2008 banking crisis.

Szczegóły książki

Szczegóły książki

54.68 €

- Pełny tytuł: Casino Capitalism

- Autor: HansWerner Sinn

- Język:

Angielski

Angielski - Oprawa: Miękka

- Liczba stron: 402

- EAN: 9780199659883

- ISBN: 0199659885

- ID: 01199039

- Wydawca: Oxford University Press

- Waga: 584 g

- Wymiary: 153 × 233 × 21 mm

- Data wydania: 16. August 2012

Ulubione w innej kategorii

-

Market Wizards

22.59 € -24 % -

Common Stocks and Uncommon Profits and Other Writings

23.10 € -20 % -

Study Guide to Technical Analysis of the Financial Markets

31.97 € -21 % -

Rule No. 1

11.29 € -28 % -

106 Mortgage Secrets All Borrowers Must Learn -- But Lenders Don't Tell

15.33 € -19 % -

Options, Futures, and Other Derivatives, Global Edition

74.75 € -

Money Culture

11.29 € -28 % -

New Trading for a Living - Psychology, Discipline, Trading Tools and Systems, Risk Control and Trade Management

63.05 € -23 % -

New Trading for a Living Study Guide

33.79 € -28 % -

Trading Price Action Reversals - Technical Analysis Price Charts Bar by Bar for the Serious Trader

54.07 € -29 % -

ABCs of Real Estate Investing

21.78 € -15 % -

The Little Book That Still Beats the Market

24.91 € -13 % -

Fooled by Randomness

10.99 € -23 % -

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

17.95 € -27 % -

Learn to Earn

14.72 € -23 % -

Reminiscences of a Stock Operator

18.86 € -30 % -

The Snowball

17.95 € -4 % -

Security Analysis: The Classic 1940 Edition

51.14 € -23 % -

Intelligent Investor

25.21 € -28 % -

Beginner's Guide To Day Trading Online 2nd Edition

11.29 € -28 % -

Daily Trading Coach - 101 Lessons for Becoming Your Own Trading Psychologist

33.79 € -28 % -

Getting Started in Chart Patterns

19.36 € -33 % -

Visual Guide to Elliott Wave Trading

56.49 € -18 % -

House of Morgan

25.82 € -

Trade Your Way to Financial Freedom

30.16 € -28 % -

Where Are the Customers' Yachts? or A Good Hard Look at Wall Street

16.54 € -34 % -

Trading Price Action Trends: Technical Analysis of Price Charts Bar by Bar for the Serious Trader

53.67 € -30 % -

Getting Started in Technical Anaylysis - Comprehensive Coverage

17.95 € -25 % -

Beginner's Guide to Short-Term Trading

12.80 € -36 % -

Inside the House of Money, Revised and Updated - Top Hedge Fund Traders on Profiting in the Global Markets

20.07 € -12 % -

New Market Wizards

19.06 € -13 % -

Real Book of Real Estate

15.02 € -28 % -

House of Rothschild

24.21 € -16 % -

House of Rothschild

20.27 € -34 % -

The Alchemy of Finance

23.10 € -20 % -

The Dhandho Investor

27.13 € -23 % -

Education of a Value Investor

23.80 € -22 % -

Art and Science of Technical Analysis - Market Structure, Price Action, and Trading Strategies

72.94 € -25 % -

Naked Forex - High-Probability Techniques for Trading without Indicators

70.92 € -5 % -

Principles of Banking, Second Edition

73.85 € -21 % -

Candlestick Course

51.95 € -30 % -

Reminiscences of a Stock Operator, Annotated Edition - With New Commentary and Insights on the Life and Times of Jesse Livermore

31.27 € -26 % -

Complete TurtleTrader

12.30 € -28 % -

Value Investing - From Graham to Buffett and Beyond, Second Edition

28.24 € -25 % -

Warren Buffett Portfolio - Mastering the Power of the Focus Investment Strategy

16.74 € -19 % -

Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders

26.73 € -28 % -

Contrarian Investment Strategies

27.23 € -23 % -

Unknown Market Wizards

27.53 € -23 % -

How to Trade In Stocks

19.36 € -25 %

Osobní odběr Bratislava a 2642 dalších

Copyright ©2008-24 najlacnejsie-knihy.sk Wszelkie prawa zastrzeżonePrywatnieCookies

Vrácení do měsíce

Vrácení do měsíce Zdarma od 49.99 €

Zdarma od 49.99 € 02/210 210 99 (8-15.30h)

02/210 210 99 (8-15.30h)