Code: 04428820

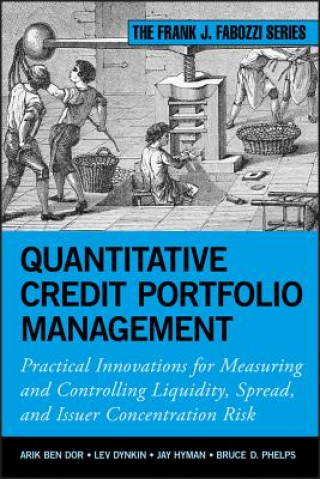

Quantitative Credit Portfolio Management: Practica l Innovations for Measuring and Controlling Liquid ity, Spread, and Issuer Concentration Risk

by Lev Dynkin

An innovative approach to post-crash credit portfolio management Credit portfolio managers traditionally rely on fundamental research for decisions on issuer selection and sector rotation. Quantitative researchers tend to use mor ... more

- Language:

English

English - Binding: Hardback

- Number of pages: 416

Publisher: John Wiley & Sons Inc, 2012

- More about this

111.02 €

RRP: 115.69 €

You save 4.66 €

In stock at our supplier

Shipping in 15 - 20 days

You might also like

-

Staring at the Sun - Overcoming the Terror of Death

16.99 € -20 % -

DESIGN THINKING PLAYBOOK - Mindful Digital Transformation of Teams, Products, Services, Businesses and Ecosystems

30.31 € -21 % -

Summer Book

11.67 € -19 % -

Business Process Management within Chemical and Pharmaceutical Industries

70.87 € -

Looking for Julie

17.10 € -2 % -

Handbook of Optical Constants of Solids

451.60 € -

Black Prince And The Sea Devils

43.21 €

Give this book as a present today

- Order book and choose Gift Order.

- We will send you book gift voucher at once. You can give it out to anyone.

- Book will be send to donee, nothing more to care about.

More about Quantitative Credit Portfolio Management: Practica l Innovations for Measuring and Controlling Liquid ity, Spread, and Issuer Concentration Risk

You get 274 loyalty points

Book synopsis

Book synopsis

An innovative approach to post-crash credit portfolio management Credit portfolio managers traditionally rely on fundamental research for decisions on issuer selection and sector rotation. Quantitative researchers tend to use more mathematical techniques for pricing models and to quantify credit risk and relative value. The information found here bridges these two approaches. In an intuitive and readable style, this book illustrates how quantitative techniques can help address specific questions facing today's credit managers and risk analysts. A targeted volume in the area of credit, this reliable resource contains some of the most recent and original research in this field, which addresses among other things important questions raised by the credit crisis of 2008-2009. Divided into two comprehensive parts, Quantitative Credit Portfolio Management offers essential insights into understanding the risks of corporate bonds--spread, liquidity, and Treasury yield curve risk--as well as managing corporate bond portfolios. Presents comprehensive coverage of everything from duration time spread and liquidity cost scores to capturing the credit spread premium Written by the number one ranked quantitative research group for four consecutive years by Institutional Investor Provides practical answers to difficult question, including: What diversification guidelines should you adopt to protect portfolios from issuer-specific risk? Are you well-advised to sell securities downgraded below investment grade? Credit portfolio management continues to evolve, but with this book as your guide, you can gain a solid understanding of how to manage complex portfolios under dynamic events.

Book details

Book details

111.02 €

- Full title: Quantitative Credit Portfolio Management: Practica l Innovations for Measuring and Controlling Liquid ity, Spread, and Issuer Concentration Risk

- Author: Lev Dynkin

- Language:

English

English - Binding: Hardback

- Number of pages: 416

- EAN: 9781118117699

- ISBN: 1118117697

- ID: 04428820

- Publisher: John Wiley & Sons Inc

- Weight: 684 g

- Dimensions: 232 × 164 × 35 mm

- Date of publishing: 20. January 2012

Trending among others

-

Common Stocks and Uncommon Profits and Other Writings

23.24 € -21 % -

House of Morgan

25.90 € -

Fooled by Randomness

11.05 € -23 % -

Market Wizards

24.06 € -20 % -

Where Are the Customers' Yachts? or A Good Hard Look at Wall Street

19.35 € -20 % -

Art and Science of Technical Analysis - Market Structure, Price Action, and Trading Strategies

78.86 € -21 % -

Trade Your Way to Financial Freedom

32.77 € -23 % -

Paths to Wealth Through Common Stocks

22.11 € -18 % -

Trading Price Action Reversals - Technical Analysis Price Charts Bar by Bar for the Serious Trader

61.65 € -21 % -

The Little Book That Still Beats the Market

24.98 € -15 % -

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

20.48 € -19 % -

Study Guide to Technical Analysis of the Financial Markets

34.20 € -17 % -

Learn to Earn

17.91 € -8 % -

House of Rothschild

24.78 € -21 % -

Security Analysis: The Classic 1940 Edition

55.10 € -18 % -

Tower of Basel

14.84 € -19 % -

Value Investing - From Graham to Buffett and Beyond, Second Edition

30.31 € -21 % -

The Snowball

18.02 € -6 % -

The Alchemy of Finance

23.24 € -21 % -

Options, Futures, and Other Derivatives, Global Edition

77.22 € -4 % -

Intelligent Investor

27.44 € -23 % -

Education of a Value Investor

26.42 € -15 % -

House of Rothschild

24.27 € -17 % -

Trading Beyond the Matrix - The Red Pill for Traders and Investors

33.38 € -18 % -

New Trading for a Living - Psychology, Discipline, Trading Tools and Systems, Risk Control and Trade Management

78.96 € -5 % -

Reading Price Charts Bar by Bar - The Technical Analysis of Price Action for the Serious Trader

64.83 € -20 % -

Daily Trading Coach - 101 Lessons for Becoming Your Own Trading Psychologist

35.63 € -23 % -

Naked Forex - High-Probability Techniques for Trading without Indicators

71.18 € -6 % -

Candlestick Course

60.12 € -21 % -

Laughing at Wall Street

15.66 € -19 % -

Catching the Wolf of Wall Street

12.28 € -23 % -

Little Book That Builds Wealth - The Knockout Formula for Finding Great Investments

23.24 € -21 % -

Contrarian Investment Strategies

28.06 € -22 % -

Complete Guide to the Futures Market, 2e - Technical Analysis, Trading Systems, Fundamental Analysis, Options, Spreads, and Trading Principles

129.87 € -2 % -

Warren Buffett Way Workbook

23.75 € -18 % -

Trump Strategies for Real Estate - Billionaire Lessons for the Small Investor

17.20 € -19 % -

Elliot Wave Techniques Simplified: How to Use the Probability Matrix to Profit on More Trades

88.39 € -

Anyone Can Learn Market Profile

20.99 € -

Visual Investor - How to Spot Market Trends 2e

51 € -3 % -

Excess Returns

49.46 € -19 % -

Housing Boom and Bust

26.62 € -

Wealth, War and Wisdom

19.55 € -3 % -

Real Book of Real Estate

16.89 € -20 % -

Rule No. 1

12.28 € -23 % -

New Market Wizards

15.87 € -18 % -

Reminiscences of a Stock Operator

21.70 € -20 % -

Alchemists: Inside the secret world of central bankers

12.28 € -23 % -

The Dhandho Investor

28.67 € -21 % -

ABCs of Real Estate Investing

21.91 € -16 %

Osobný odber Bratislava a 2642 dalších

Copyright ©2008-24 najlacnejsie-knihy.sk Všetky práva vyhradenéSúkromieCookies

21 miliónov titulov

21 miliónov titulov Vrátenie do mesiaca

Vrátenie do mesiaca 02/210 210 99 (8-15.30h)

02/210 210 99 (8-15.30h)